9 posts tagged with "Volatility"

View All Posts

7min read

November 12, 2024

How Derivatives Solve The Uniswap 'Doom Loop'

Discover how Panoptic's derivatives market stabilizes crypto spot markets, mitigates volatility, and empowers Uniswap LPs with new profitability strategies in DeFi.

4min read

August 2, 2024

21 Reasons Why Options Are Important In The Crypto Market

Options are the secret sauce of the crypto market, offering profit strategies for any market condition, top-notch risk management, and portfolio diversification. They boost market efficiency, unleash volatility trading, and open doors to advanced financial wizardry. With Panoptic's cutting-edge models, options are constantly evolving, setting the stage for groundbreaking on-chain pricing and volatility dynamics.

6min read

July 22, 2024

Reverse Gamma Scalping

Reverse Gamma Scalping in DeFi involves selling gamma with delta-hedging to profit from market volatility, leveraging strategies from traditional finance with perpetual options trading.

5min read

June 12, 2024

Gamma Scalping

Gamma scalping in Panoptic uses continuous delta-hedging and at-the-money options to profit from market volatility, integrating traditional finance strategies with perpetual options trading.

3min read

March 11, 2024

Understanding Delta Risk

Explore the critical role of delta in options trading for risk management and master delta-neutral strategies with Panoptic to navigate market volatility effectively.

2min read

May 12, 2023

Panoptic Insights: Betting on Volatility

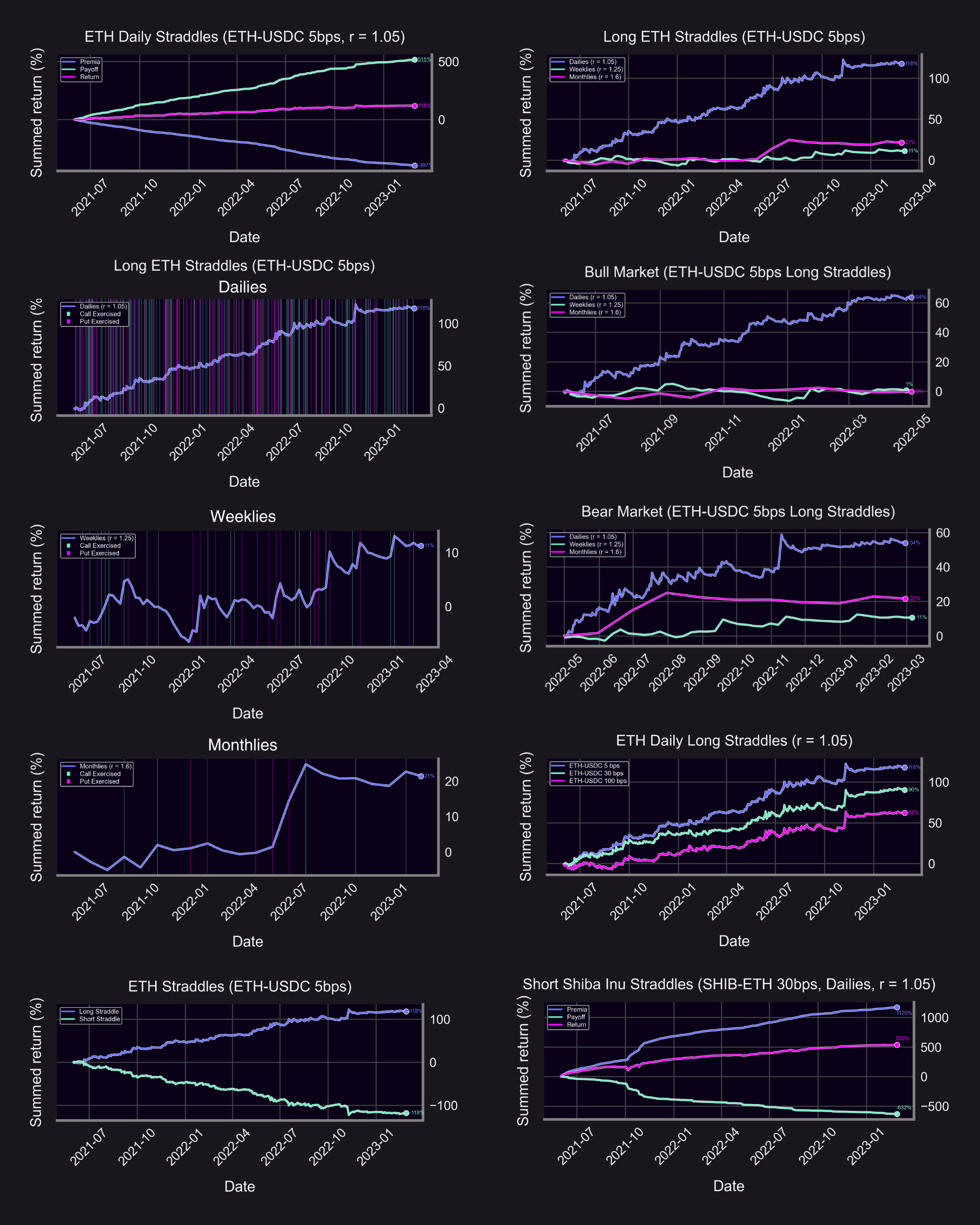

We analyze how straddles perform when volatility is low.

4min read

May 10, 2023

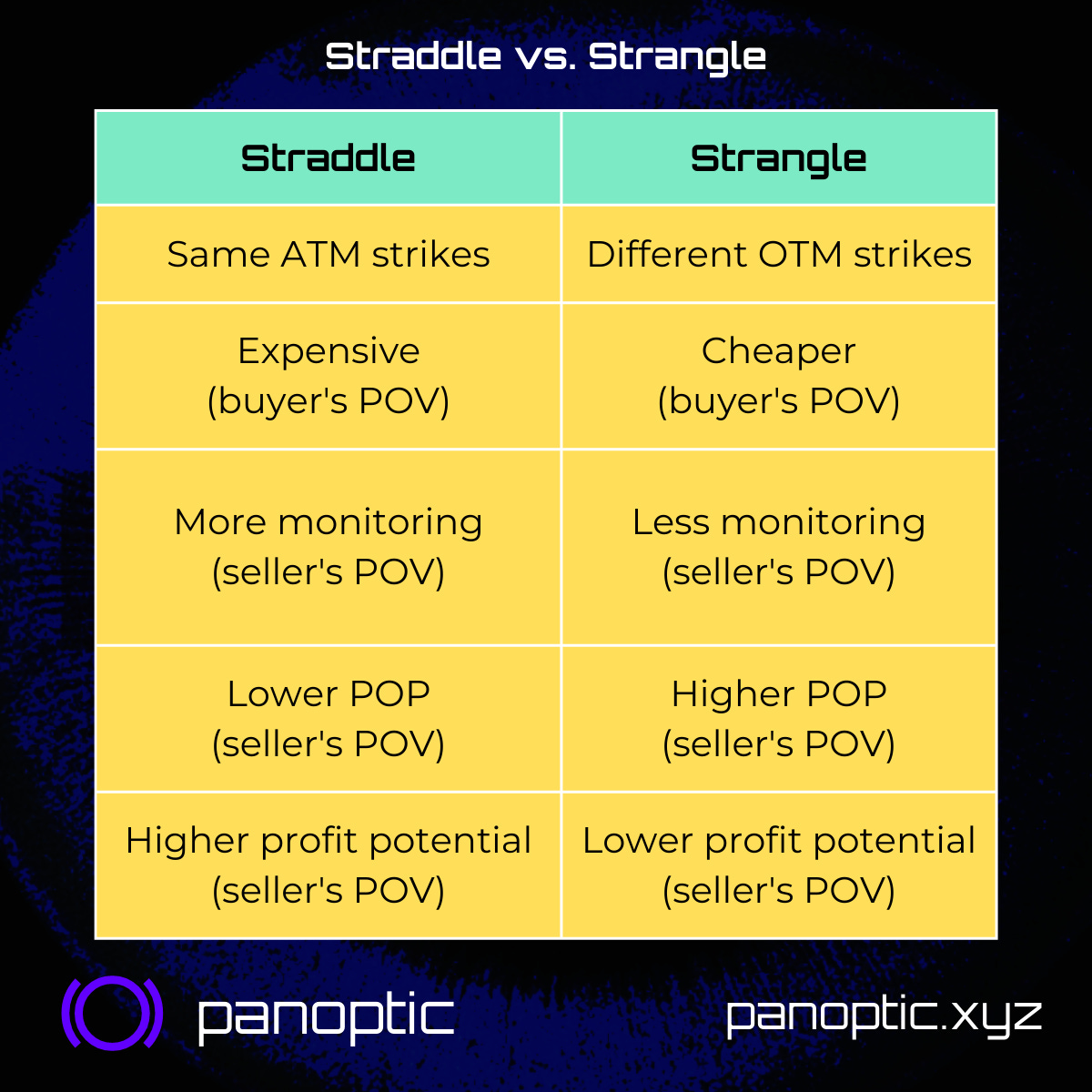

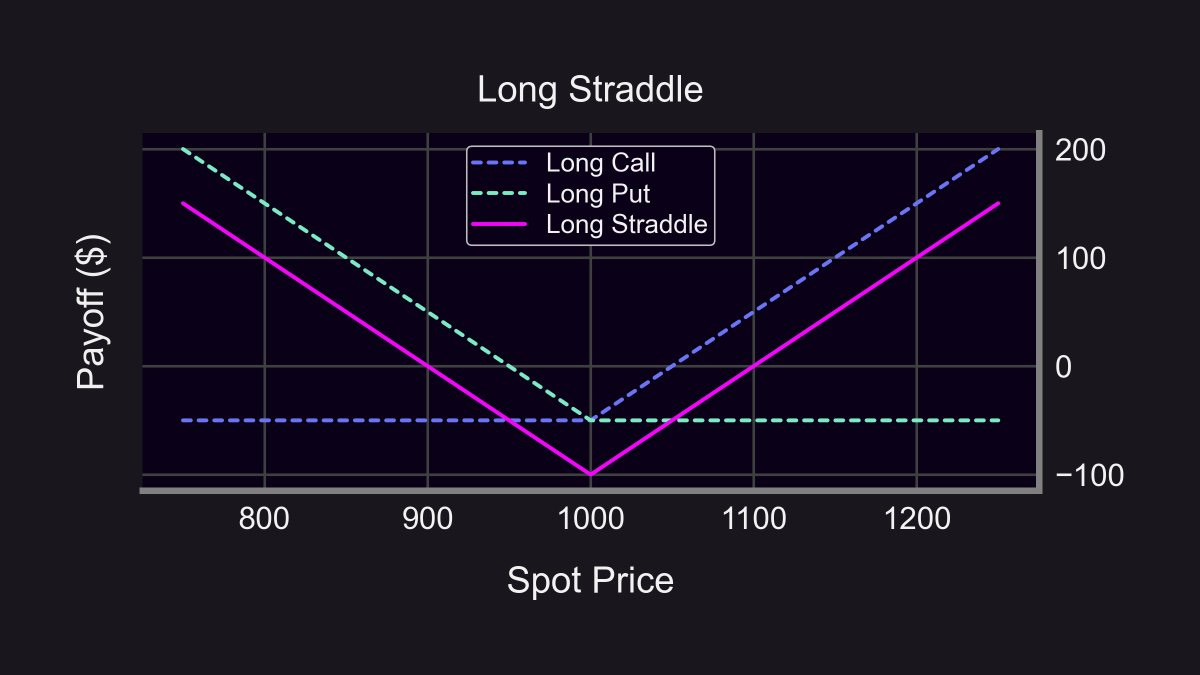

Volatility Bets - Straddles vs. Strangles

Straddles and strangles are options strategies that let you bet on volatility. Here's how they differ.

3min read

April 27, 2023

Maximizing Profits: Long vs. Short Straddles

We backtest straddles on Uniswap v3.

2min read

April 25, 2023

Options Trading 101: Straddles

Did you know that you can profit from the price moving both up AND down? Here's how.