Liquidity Providers (LPs)

Panoptic empowers LPs with increased yield, impermanent loss (IL) mitigation, advanced strategies, and risk management.

Increased Yield

LPs who deposit liquidity into AMMs like Uniswap v3 are unable to earn additional yield on their LP token. This is because Uniswap v3 represents LP tokens as NFTs, which are harder to integrate into the rest of the DeFi ecosystem.

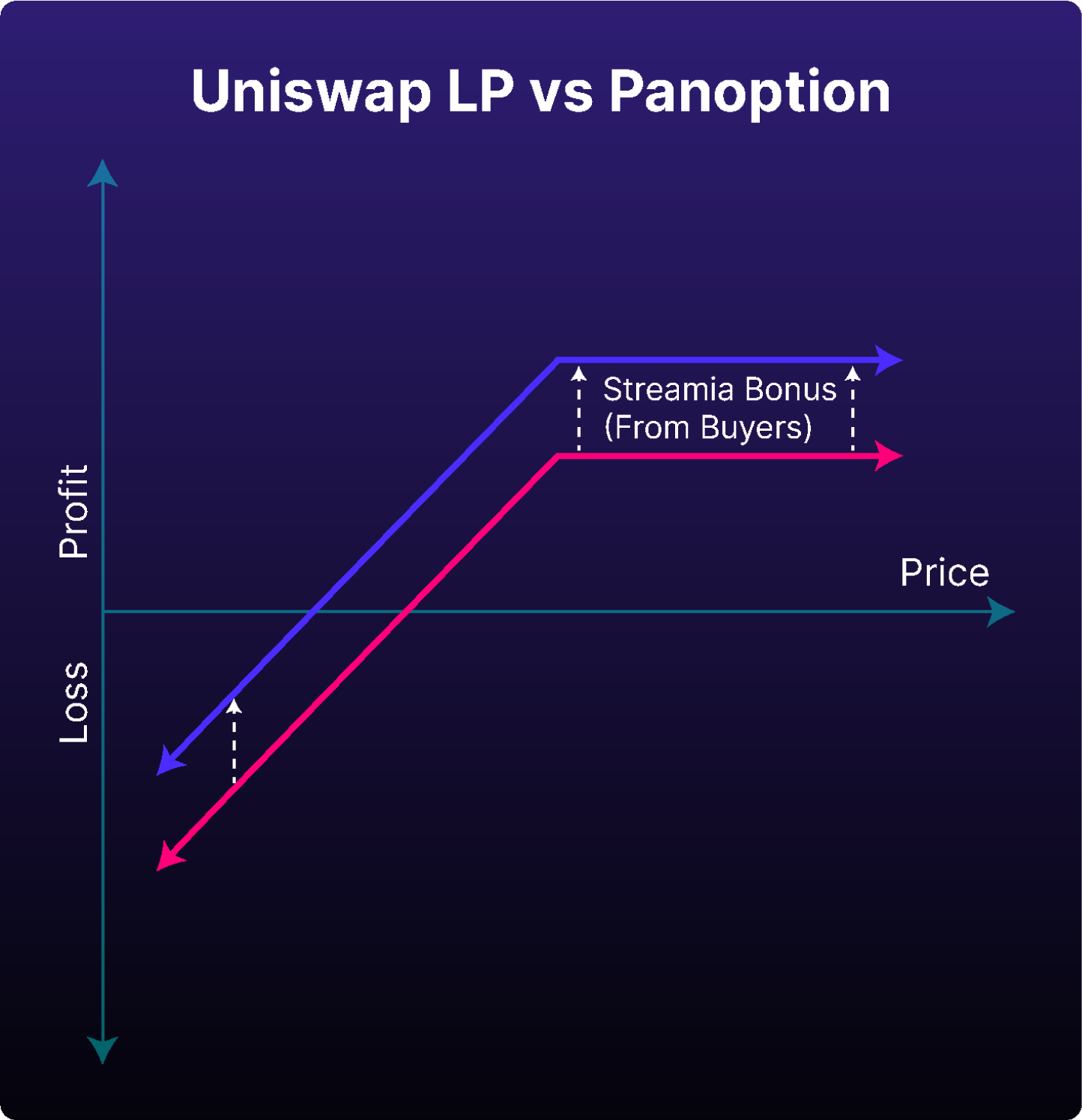

Through Panoptic's innovative Semi-Fungible Position Manager, LPs are able to lend out their LP tokens for additional yield. LPs still earn all of the fees they would have been entitled to on Uniswap, plus an additional yield that comes from options buyers who are borrowing the LP token.

Impermanent Loss (IL) Mitigation

LPs don't need to feel trapped by IL when they understand options. IL is simply gamma risk in options trading: the accelerating risk of assets conversion away from the initial 50:50 ratio.

LPs can use Panoptic to control and decrease the amount of IL suffered. To mitigate IL, LPs can:

- Use Panoptic to deploy liquidity onto Uniswap. Deploying through Panoptic enables your LP token to be lent out to other traders, which increases your profitability and decreases your IL.

- Buy perpetual options to transform naked positions into spreads.

- Keep track of and neutralize your delta and gamma.

- Trade wide positions to limit pin risk.

Advanced strategies

LPs are selling perpetual put options, whether they know it or not. Panoptic embraces this discovery by utilizing concentrated liquidity pool on Uniswap v3 to create option payoffs for users. Instead of only selling put options, LPs can use Panoptic as a one-stop shop to also buy put options, buy call options, sell call options, trade delta-neutral straddles, and more. Stop being restricted to only trading neutral-to-bullish positions in AMMs, and start exploring the world of bearish, delta-neutral, bullish, long volatility, and short volatility trades!

Risk Management

LPs can take advantage of Panoptic's visual interface, that allows them to:

- Choose the right LP width based on their desired timescale.

- Easily monitor their position's P&L, delta, gamma, and other Greeks.

- Decide when to open or close an LP position based off of the risk dashboard's implied volatility (IV) metric

- Rebalance their LP position through Panoptic's gas-efficient and low-cost rolling mechanism.