Advanced trading strategies

Advanced options trading strategies are designed to help traders achieve their financial objectives while minimizing their risk exposure.

In this guide, we'll cover three advanced options trading concepts:

- Defined/undefined risk

- Spreads

- Synthetic positions

Managing Defined/Undefined Risk

Options strategies can be divided into two types of risks:

- Defined risk: Strategy where there is a maximum possible loss which is known in advance.

- Undefined risk: Strategy where there is potential for unlimited loss.

Managing risk is crucial when trading options, and it's important to understand how to do so effectively.

Defined Risk Options Trading Strategy

A popular defined risk options trading strategy is a bull call spread. This strategy involves buying a call option at a lower strike price and selling a call option at a higher strike price.

10/25 Bullish on $ETH but don't expect a huge surge?

— Panoptic (@Panoptic_xyz) February 22, 2023

Buy a "call spread" on Panoptic! 📞🧈

Limited upside 😋

Limited downside 😋

Bullish ⬆️

Long call (lower strike) + short call (higher strike) pic.twitter.com/hifZzzyZCL

This strategy limits both the potential profit and potential loss of the trade.

For example, suppose you are bullish on ETH, which is currently trading at $100. You can create a bull call spread by buying a call option with a $90 strike price for a premium of $7 and selling a call option with a $110 strike price for a premium of $5.

If ETH price rises above $110 by expiration, your profit will be limited to the difference between the strike prices ($110 - $90 = $20) minus the net cost of the options ($7 - $5 = $2). In this case, the maximum profit is $18 ($20 - $2).

If ETH price falls below $90, your loss will be limited to the net cost of the options ($7 - $5 = $2).

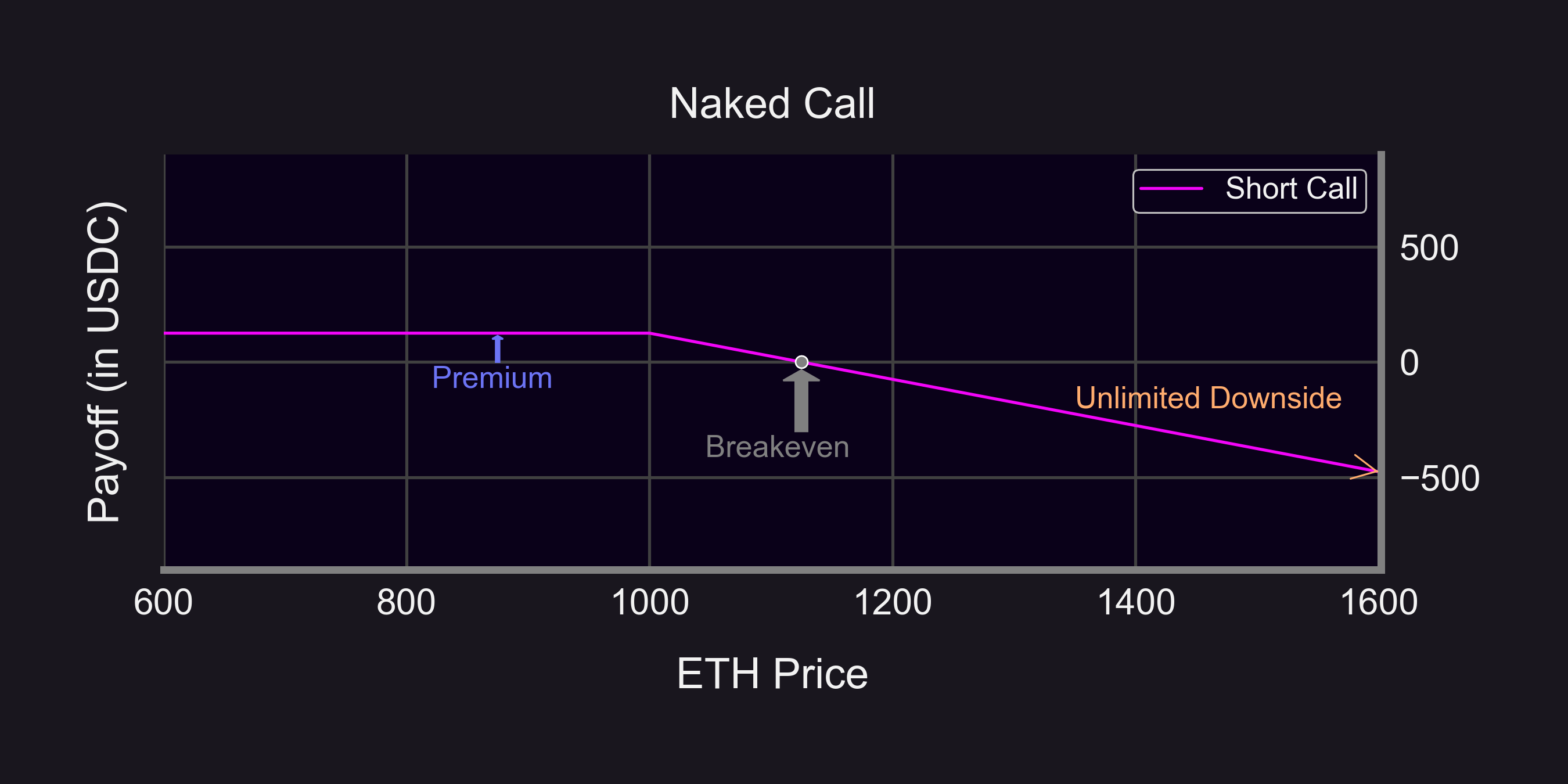

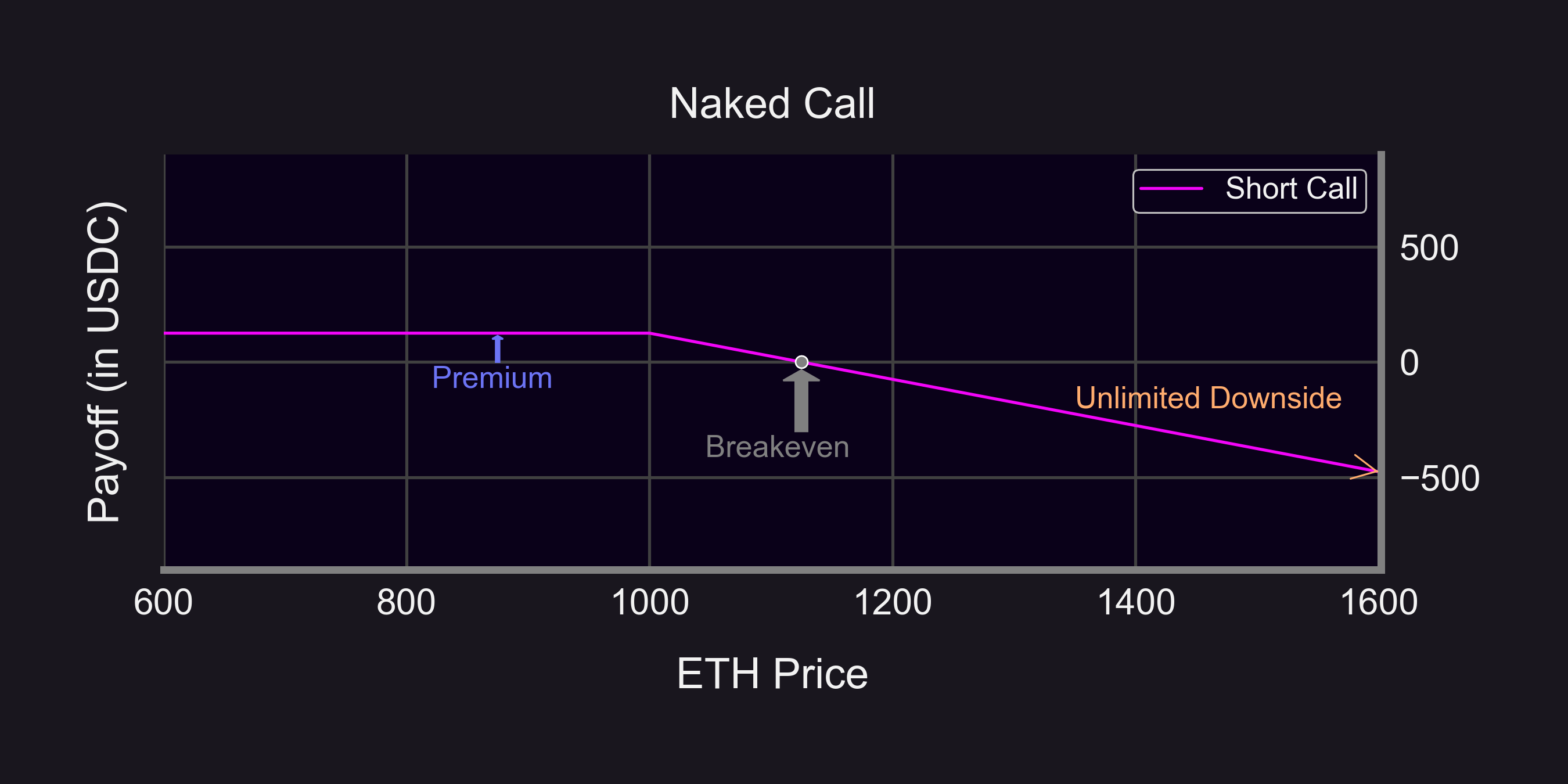

Undefined Risk Options Trading Strategy

An example of an undefined risk options trading strategy is selling a naked call option. This strategy involves selling a call option without owning the underlying token.

If ETH price rises above the strike price of the sold call option, the trader could face unlimited losses.

For example, suppose you are neutral-to-bearish on ETH, which is currently trading at $1,000. You can sell a (naked) call option on ETH with a $1,000 strike price for a premium of $125.

If ETH price rises above the strike price, e.g. $1,200, the call option can be exercised, and you will be obligated to sell 1 ETH at $1,000. But because you do not own any ETH (this is a naked position), you must acquire ETH on the open market by buying ETH at the current price ($1,200). Thus, you purchase ETH for a high price ($1,200) and sell it at a low price ($1,000) for a loss ($125 + $1,000 - $1,200 = -$75).

However, if the option is not exercised and ETH price continues to rise, your losses would increase (without limit).

Spreads

A spread is an options trading strategy that involves buying and selling options (each option is a "leg") on the same underlying asset. However, the strike price or expiration date (in TradFi) of each leg may differ. Spreads can be used to limit risk and increase potential profit.

Vertical Spread

One type of spread is a vertical spread. A vertical spread involves buying and selling options with the same expiration date (in TradFi) but different strike prices.

For example, if you're bullish on ETH, you can buy a call option with a lower strike price and sell a call option with a higher strike price. This strategy will limit your risk while giving you the potential for profit if ETH price stays between the two strikes. This is an example of a bull call spread, which is also described above.

Horizontal Spread

Another type of spread is the horizontal spread (also called a calendar spread). A horizontal spread involves buying and selling options with the same strike price but different expiration dates. This strategy can be used to profit from changes in the implied volatility of the options.

15/25 Long-term bullish on $ETH but need more capital?

— Panoptic (@Panoptic_xyz) February 22, 2023

Buy a "call calendar spread" on Panoptic! 📞📅🧈

Limited upside 😋

Limited downside 😋

Delta neutral 🫥

Long long-term call + short short-term call (same strike) pic.twitter.com/dldgB8vORW

Diagonal Spread

Another type of spread is the diagonal spread (also called the "Poor Man's Covered Call"). A diagonal spread involves buying and selling options with different strike prices and different expiration dates.

17/25 A variation of 📅🧈 is the "diagonal spread" ↗️🧈

— Panoptic (@Panoptic_xyz) February 22, 2023

Also called a "Poor Man's Covered call" — useful when you expect minor price movement.

Limited upside 😋

Limited downside 😋

Bullish ⬆️

Long long-term call + short short-term call (different strikes) pic.twitter.com/zoj4CKVJUK

While its payoff is similar to that of a covered call, its capital requirements are much lower. This makes the diagonal spread a capital-efficient version of the covered call.

Synthetic Perps

A synthetic position is a trading strategy that involves creating a position that mimics the risk/reward profile of another position. Typically, this results in higher capital efficiency, as you are exposed to the profit profiles of some position without actually holding it. On Panoptic, you can use perpetual options to create synthetic perpetual futures (perps).

Synthetic Long Perp

A synthetic long perp is a trading strategy that uses options to mimic the risk/reward profile of owning some asset. To create a synthetic long perp, a trader can buy a call option and sell a put option with the same strike price and the same expiration date (in TradFi).

For example, let's say a trader wants to create a synthetic long perp on ETH, which is currently trading at $100. The trader can buy a call option with a $100 strike price and sell a put option with a $100 strike price, both expiring in one month (in TradFi).

At the end of one month (in TradFi options), the profit from the synthetic position is similar to the profit of purchasing ETH outright:

If ETH price rises above $100, e.g. to $120, the trader's long call option is ITM with intrinsic value of $20, while the trader's short put option expires OTM. The intrinsic value is the same as the profit from purchasing ETH outright ($20).

If ETH price falls below $100, e.g. to $90, the trader's long call option expires worthless, while the trader's short put option is ITM with intrinsic value of $10. The intrinsic value (which is a loss to the trader who sold the put) is the same as the loss from purchasing ETH outright ($10).

If ETH price remains at $100, both options expire worthless with intrinsic values of $0. This is the same as the PnL from purchasing ETH outright ($0).

In every case, the synthetic position's value is similar to buying the asset outright. However, there are also some differences:

- In the synthetic position, the trader had to purchase the call option (e.g. for a $7 premium) and sell the put option (e.g. for a $5 premium). This is a total cost of $2 ($7 - $5).

- The trader's synthetic position is more capital efficient because the trader only needed $2 in upfront capital. This is much lower than the required capital to buy the asset outright ($100).

- The trader's synthetic position incurs an upfront loss ($2) to finance the options position. Had the trader bought the asset outright, the trader would not have incurred this loss.

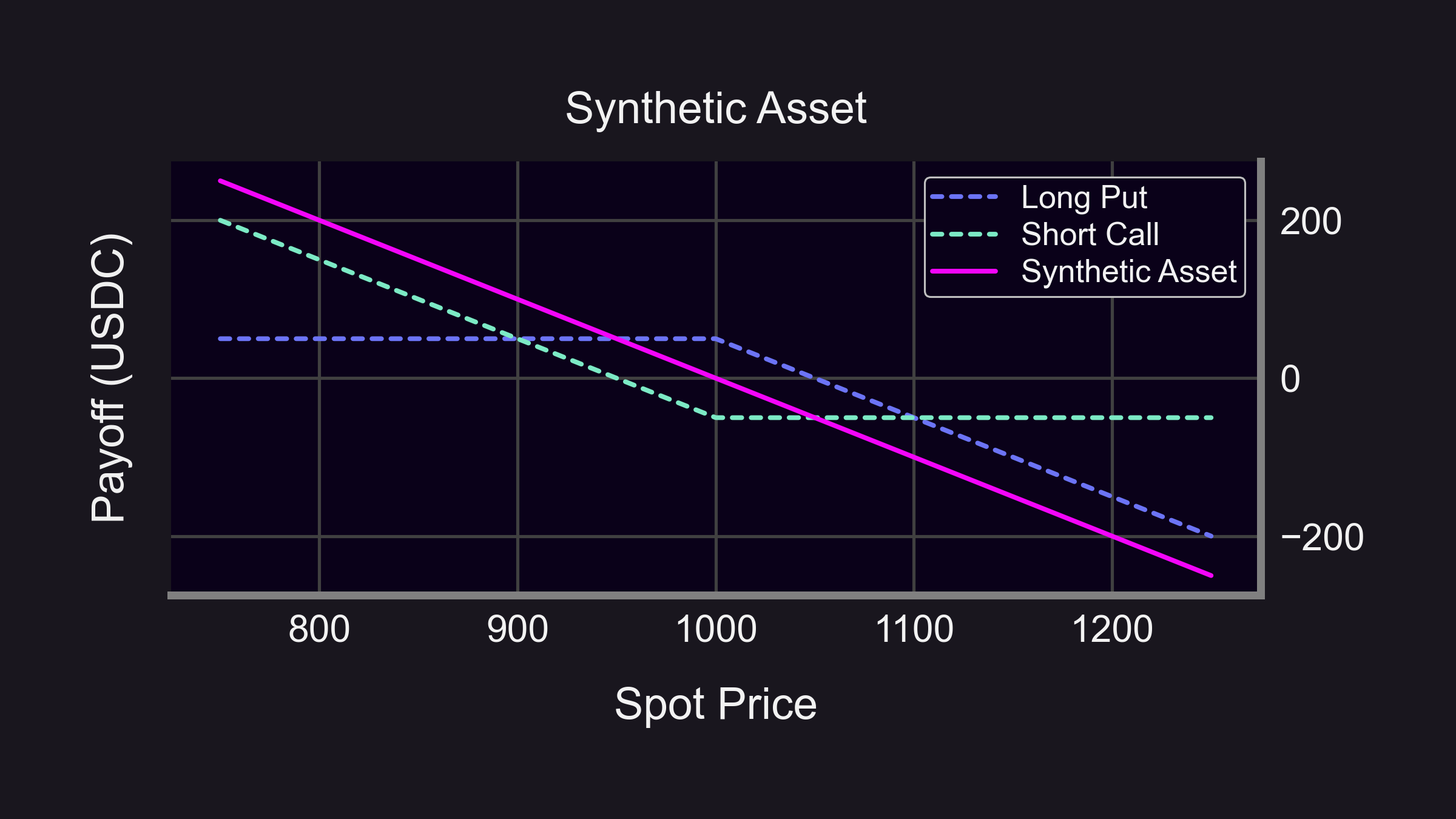

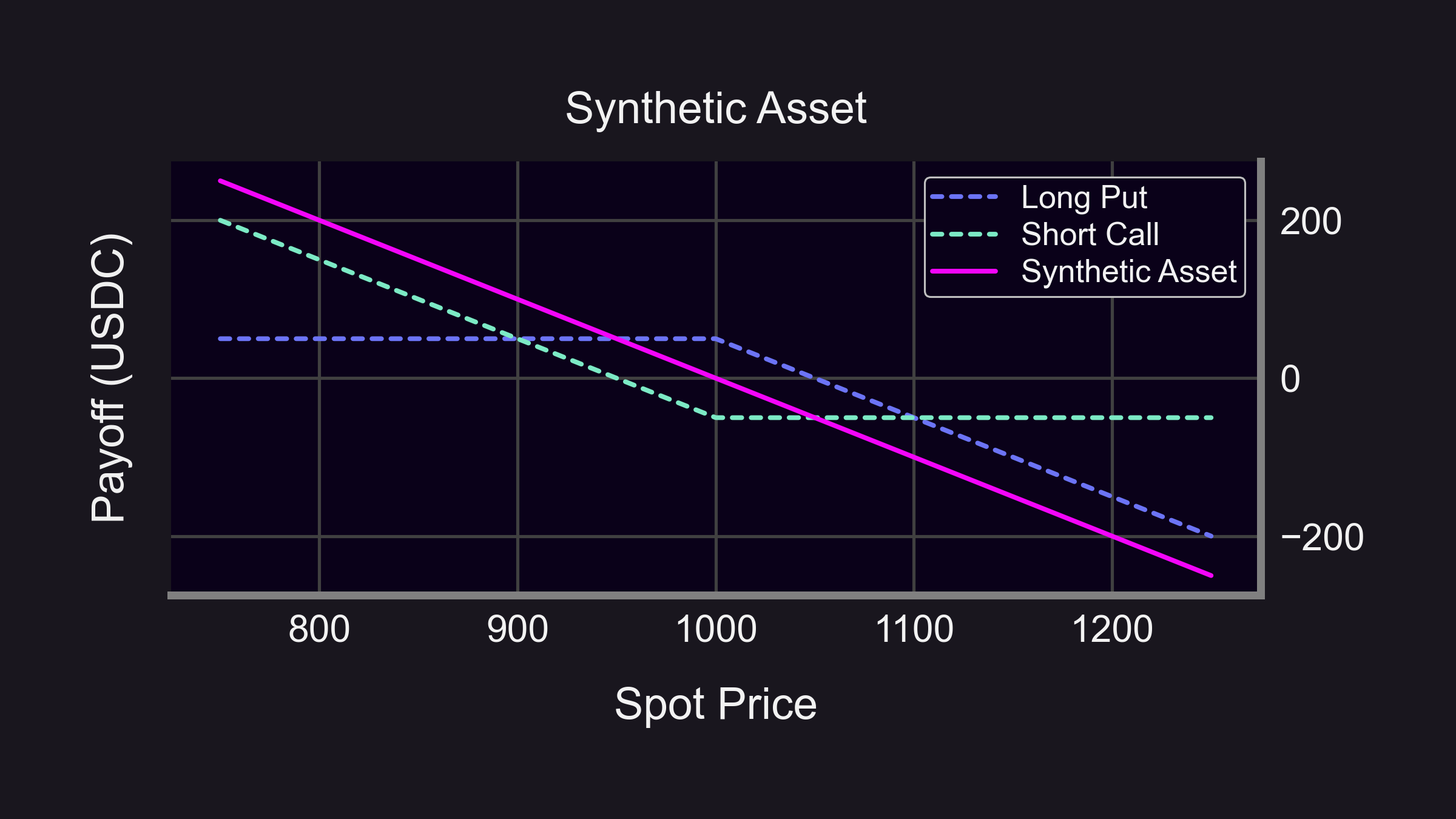

Synthetic Short Perp

Conversely, a synthetic short perp is a trading strategy that uses options to mimic the risk/reward profile of shorting some asset. To create a synthetic short perp, a trader can sell a call option and buy a put option with the same strike price and the same expiration date (in TradFi).

For example, let's say a trader wants to create a synthetic short perp on ETH, which is currently trading at $100. The trader can sell a call option with a $100 strike price and buy a put option with a $100 strike price, both expiring in one month (in TradFi).

At the end of one month (in TradFi options), the profit from the synthetic position is similar to the profit of purchasing ETH outright:

If ETH price rises above $100, e.g. to $120, the trader's short call option is ITM with intrinsic value of $20, while the trader's long put option expires worthless. The intrinsic value (which is a loss to the trader who sold the call) is the same as the loss from shorting ETH outright ($20).

If ETH price falls below $100, e.g. to $90, the trader's short call option expires OTM, while the trader's long put option is ITM with intrinsic value of $10. The intrinsic value is the same as the profit from shorting ETH outright ($10).

If ETH price remains at $100, both options expire worthless with intrinsic values of $0. This is the same as the PnL from shorting ETH outright ($0).

In every case, the synthetic position's value is similar to shorting the asset outright. However, there are also some differences:

- In the synthetic position, the trader had to purchase the put option (e.g. for a $7 premium) and sell the call option (e.g. for a $5 premium). This is a total cost of $2 ($7 - $5).

- The trader's synthetic position is more capital efficient because the trader only needed $2 in upfront capital. This is much lower than the required capital to short the asset outright (up to $50 depending on the margin account).

- The trader's synthetic position incurs an upfront loss ($2) to finance the options position. Had the trader shorted the asset outright, the trader would not have incurred this loss.

Want a more visual tutorial of advanced options strategies? Check out our post: 18 Options Strategies Every Trader Should Know (With Emojis)!